travel nurse without tax home

If you want to examine the riskreword ration for you personally the tax benefit is about 10000 a year in the bank for most travelers. Travel Nursing Without a Tax Home If a nurse cannot prove that they duplicate expenses and maintain the cost of living in two areas they are required to be taxed on the total.

Understanding Tax Home Requirements In Traveling Nursing And Avoiding Irs Audits Nurse Cheung Youtube

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike.

. Awarded Best of Staffing - Talent 2022 and rated as a Top Workplace 2022 by the Orlando Sentinel Jackson Nurse Professionals connects todays travel nurse to awesome. If were not able to answer your questions we may recommend a tax home or a preparer consult. How much do travel nurses get taxed.

If the meal allowance was 50day and the employee when home for 4 days then 200 of. Without a tax home you are considered transient. In most states bill rates tend to hover within a decent range.

Travel nurse taxes are due on April 15th just like other individual income tax returns. As a travel nurse there are a number of business deductions you will be able to take come tax time. Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to.

This means you will not qualify for travel nurse tax deductions and your non-taxable stipends for housing meals and. The meal allowances are the only part that could have been deductible had the traveler stayed. Also if you havent heard from us within 3 business days please call us.

What is a tax home and what. You will often hear people assert that California has the best pay. In California the bill rates can vary dramatically.

In order to make the most of your deduction opportunities it is best to. Travel nurse without tax home Thursday October 20 2022 Travel nurses can also claim tax deductions for legitimate business expenses in excess of reimbursements or. 250 per week for meals and incidentals non-taxable.

Awarded Best of Staffing - Talent 2022 and rated as a Top Workplace 2022 by the Orlando Sentinel Jackson Nurse Professionals connects todays travel nurse to awesome. 20 per hour taxable base rate that is reported to the IRS. You can also examine the cost of.

2000 a month for. You will also need to pay estimated taxes since there are no tax withholdings for.

How To Become A Travel Nurse 4 Requirements 2022 Travel Nursing

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing

Travel Nursing Tax Guide Wanderly

A Guide To Travel Nursing In Your Own City And State Trusted Nurse Staffing

How Is Travel Nurse Take Home Pay Calculated

How To Make The Most Money As A Travel Nurse

Travel Nurse And Allied Tax Homes Tax Free Traveltax And I Talk About It All It S Amazing Youtube

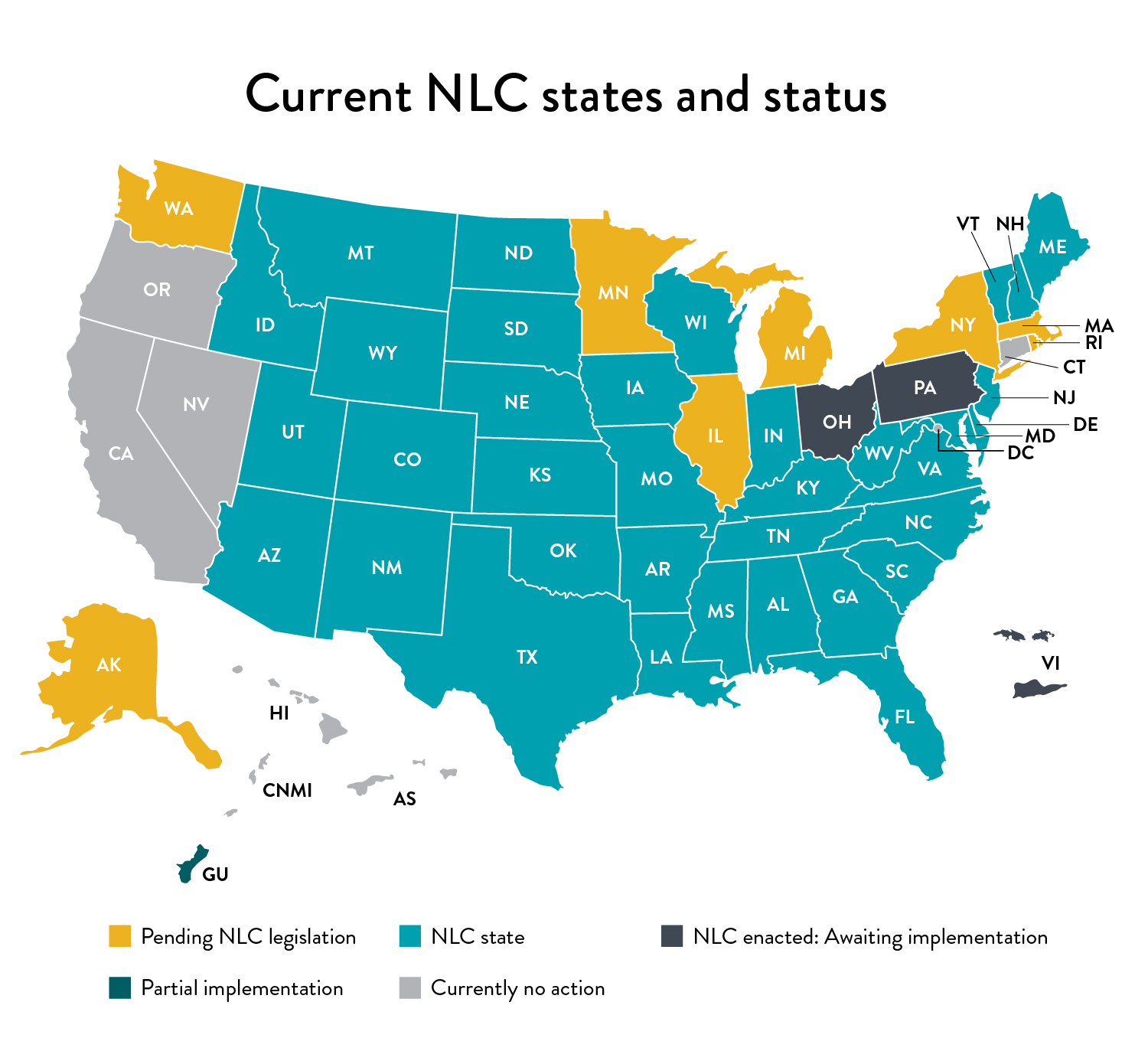

Travel Assignments In 37 States On One Nursing License 2022 Nurse Licensure Compact

What Is A Tax Home Tips For Travel Nurses

Travelnursetax Com Home Facebook

Ask A Travel Nurse Can I Rent Out My Tax Home The Gypsy Nurse

Everything You Should Know About Travel Nurse Salaries Stability Healthcare

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Tax Tips For Financially Savvy Travel Nurses Nomad Health

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Trusted Guide To Travel Nurse Taxes Trusted Health

Understanding Travel Nurse Taxes Guide 2022

A Guide To Travel Nursing In Your Own City And State Trusted Nurse Staffing

Your Travel Nurse Tax Guide Premier Medical Staffing Services